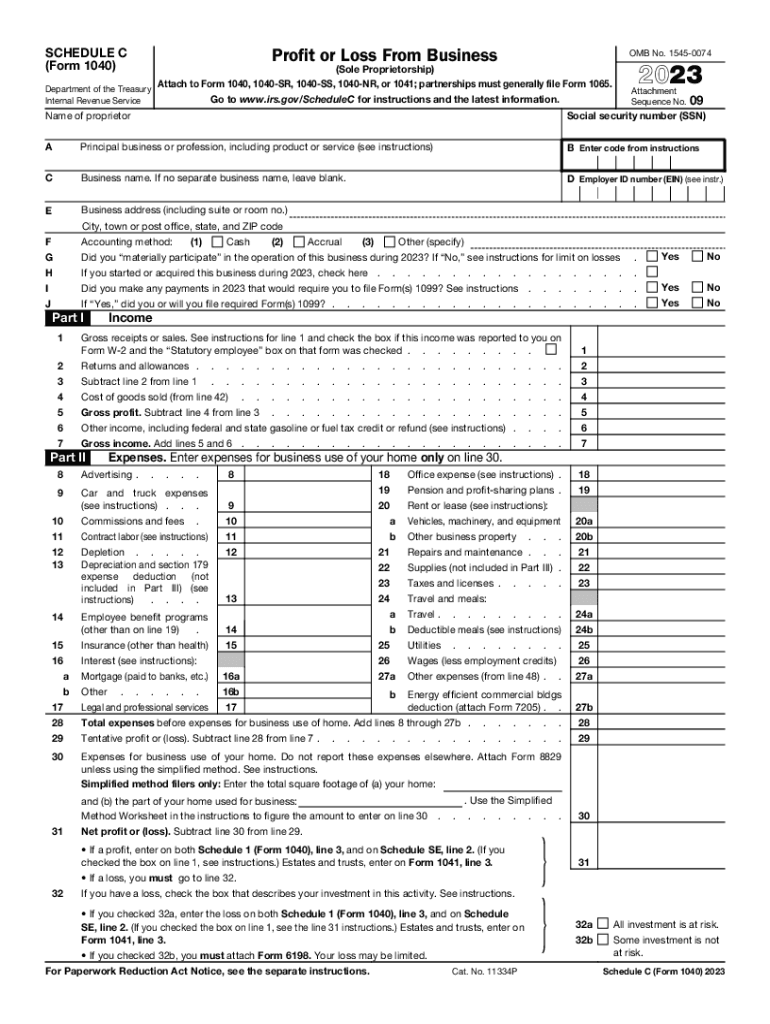

1040 Schedule C 2024 Tax Form – If your finances have been hit hard in recent months, the last thing you want to do is shell out more cash to file your taxes — which is already a dreaded experience for many. Fortunately, you may be . In 2022, for example, the deadline to pay first quarter estimated taxes is Monday, April 18, due to the Emancipation Day holiday in Washington, D.C Provides Tax Inflation Adjustments for Tax Year .

1040 Schedule C 2024 Tax Form

Source : www.kxan.com2023 Form IRS 1040 Schedule C Fill Online, Printable, Fillable

Source : 1040-schedule-c.pdffiller.comBusiness tax deadlines 2024: Corporations and LLCs | Carta

Source : carta.com2018 2024 Form IRS 1040 Schedule C EZ Fill Online, Printable

Source : irs-schedule-c-ez.pdffiller.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comWhat Is Schedule C (IRS Form 1040) & Who Has to File? NerdWallet

Source : www.nerdwallet.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 | Money

Source : www.youtube.comHow to Fill Out Schedule C Form 1040 for 2023 | Taxes 2024 – Money

Source : content.moneyinstructor.comIRS Schedule C (1040 form) | pdfFiller

Source : www.pdffiller.comTaxes Schedule C Form 1040 (2023 2024) | PDFliner

Source : pdfliner.com1040 Schedule C 2024 Tax Form Harbor Financial Announces IRS Tax Form 1040 Schedule C : The deductions are documented on Internal Revenue Service Schedule C, which is filed with the small business owner’s Form 1040. Workers part of the individual tax filings by the owner or . The easiest way to claim a home-office tax break is by using the standard home-office deduction, which is based on $5 per square foot used for business up to 300 square feet. The “regular method” for .

]]>